What is the Florida statute of limitations on financial obligation and collection laws?

Disclosure concerning our editorial content requirements. If you have an old arrearage in Florida, you might be fretted that your financial institution or a debt collector will follow you. However, the statute of limitations plays a substantial function in financial obligation collection. For the most part, the maximum statute of limitations for Florida debt is five years, although some debts only have a statute of limitations of four. This implies a financial institution only has four to five years to sue you for the debt you owe.

What is the statute of constraints?

< img width =" 1500"height =" 700"src="https://www.creditrepair.com/blog/wp-content/uploads/2022/06/CR-Blog-images-Template-not-social-34.png" alt= "A statute of restrictions is a law that sets a maximum time throughout which a celebration can start legal proceedings, such as a claim, versus another celebration. The statute of constraints normally starts from the day the occasion happened. There's a statute of restrictions for different offenses, including failure to pay debts. Each state can set its own statute of restrictions on debt collection claims.

“/ > A statute of constraints is a law that sets a maximum time during which a party can start legal proceedings, such as a lawsuit, against another celebration. The statute of limitations generally begins with the day the event happened. There's a statute of limitations for numerous offenses, including failure to pay financial obligations. Each state can set its own statute of restrictions on debt collection claims.

Normally speaking, the statute of limitations exists due to the fact that

proof and the probability of a strong case weaken as time goes on. The law does not want to permit or reward individuals for inaction, so people are offered an affordable duration when they can bring forward legal action. What does time-barred mean? After the statute of limitations passes, debt ends up being time-barred. When somebody describes”time-barred debt,”it suggests cash was obtained and never paid back however is no longer lawfully collectible since the statute of limitations has

passed. What does tolled mean? Tolled is likewise known as “extending the statute.” Financial obligation can be tolled when a consumer takes an action that legally enables the statute of restrictions to be extended.

For example, let's say a private overlooks all interaction tries from their financial institution and relocates to another state due to the fact that they understand there's just one year left before the statute of constraints is up. In this case, the creditor can take action to toll the debt, and if the individual ever moves back, the creditor gets that year back on their statute.

In some states, debt can be tolled if the customer admits they know about the debt or makes a deposit. For this factor, consumers must beware when dealing with creditors.

Keep in mind that tolling a statute of restrictions just uses to financial obligations with a composed contract, such as a loan or charge card contract.

How does the statute of limitations work with debt in collections?

If your debt remains in collections, whoever presently owns the debt can submit a lawsuit versus you as long as the statute of limitations hasn't passed. This means that even if your initial financial institution has actually crossed out the debt and passed it on to a debt collection agency, that firm can still take legal action within the allowed five-year statute.

What if the statute of restrictions has passed?

Once the statute of constraints has actually passed, a financial institution can no longer take legal action versus you. If they attempt to, you can submit a movement to dismiss the case. The court will not have your account records, so the obligation will be on you to prove the statute of restrictions has actually passed. When you can show that, your case will be dismissed.

Note that while the lenders can't take legal action, they can still try to contact you for collection on the account, and it can still appear on your credit report.

Take care in engaging with your creditors, as you can unintentionally reset or “toll” the statute of limitations. Don't try to interact with them about dropping the claim, using partial payments or acknowledging the debt, as this can have undesirable consequences.

What is the Florida law on the statute of constraints?

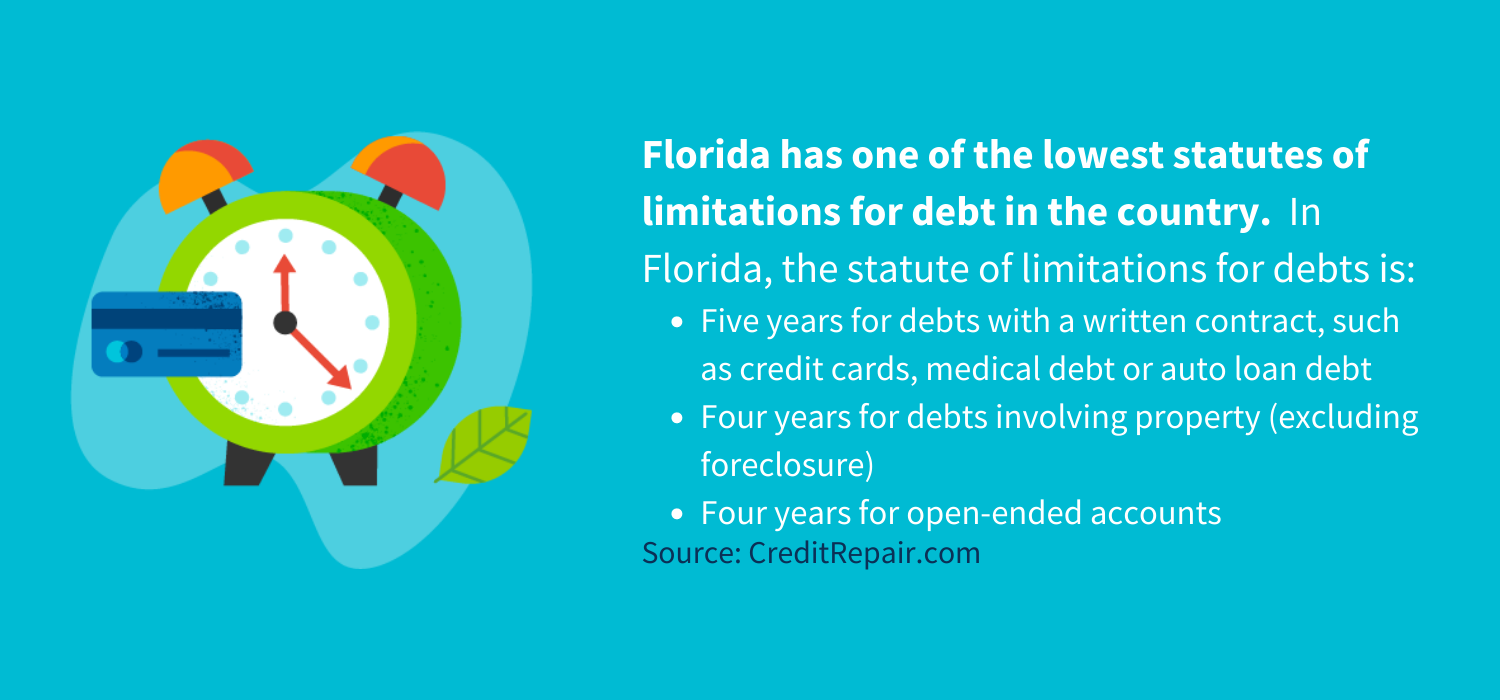

Florida has among the most affordable statutes of restrictions for

of six years. In Florida, the statute of restrictions for debts is: 5 years for debts with a composed contract, such as charge card, medical debt or car loan debt 4 years for debts including property(omitting foreclosure)Four years for open-ended accounts The statute of limitations typically begins with the last activity on the account, whether that's a payment, a charge or a credit. Note that the statute of restrictions just uses to legal action for customer financial obligations in Florida. This suggests a debt collection agency or creditor

can continue to try to gather on the debt even past the statute– they simply can't submit a claim. Additionally, in Florida, making a deposit on a debt will

toll the financial obligation, resetting the statute of limitations. One important distinction is that if a judgment has actually been gone into versus you in court, the statute of constraints for Florida financial obligation expands to 20 years and will continue to accrue interest until it's paid. In some cases, financial institutions can have specific assets took or incomes garnished to recuperate what's owed.

What debt falls under the statute of limitations?

The debts that fall under the statute of limitations include:

- Charge card

- Individual loans

- Home mortgages

- Automobile loans

- Personal student loans

- Medical financial obligation

- State tax financial obligation

Some financial obligations have no statute of constraints, including federal trainee loans and overdue kid assistance.

What should you do if you are being demanded old financial obligation?

If you're being demanded old financial obligation in Florida, the initial step is to figure out the date of the last activity on the account. Depending upon the kind of debt, you know you have a 4- or five-year statute of constraints. If you feel confident that the statute of constraints has passed, do not speak with the creditor and don't make any payments. Rather, employ a lawyer to review your case and submit a motion to dismiss the lawsuit.

On the other hand, if you're being sued for an old debt however the statute of restrictions hasn't passed, you'll require to come up with a strategy. If the financial obligation is precise, the judge will likely side with the lender. As a result, you may find that you get a judgment, such as a wage garnishment or a lien placed on your home. The total quantity you'll owe may cover the original financial obligation, along with any interest, costs and possibly attorney costs.

It's extremely recommended that you show up to court and attempt to protect yourself, even if you understand the financial obligation is accurate. Appearing to court increases the chances the judge will offer you a lighter charge.

What should you do if you have debt in collections that hasn't passed the statute of constraints?

Let's say you have debt in collections that hasn't passed the statute of constraints however you have not been served a lawsuit, either. The essential thing here is not to linger and hope the financial institution doesn't take legal action against you. Rather, it's vital to interact with the lender and attempt to remedy the situation.

If the financial obligation is precise, you have a couple of choices:

- If you have the cash readily available, use a one-time lump-sum payment for less than you owe. In exchange for this payment, you'll inquire to think about the financial obligation settled, and you may even ask to get rid of the debt from your credit report (spend for delete letter). If you pursue this alternative, get whatever in composing so you have evidence of the pledges made.

- If you do not have the cash for a lump-sum payment, reach out and ask your financial institution if you can establish a month-to-month payment strategy. This can avoid you from being brought to justice as long as the creditor agrees and you stay with your payments. Once again, get whatever in writing.

If the debt is unreliable, you'll wish to challenge to possibly have it gotten rid of from your credit report and stops impacting your credit score. You have the legal right to a reasonable and precise credit report, and debt collectors can't come after you for unreliable financial obligations.

It's possible to submit a disagreement independently with the credit bureaus, however many individuals choose to get professional aid in this area. For example, CreditRepair.com members saw over 8.2 million eliminations on their credit reports because 2012.

There's no reason you need to do this alone– let our credit repair work advocates assist you today.

Keep in mind: The info supplied on CreditRepair.com does not, and is not intended to, serve as legal, monetary or credit advice; rather, it is for general informational functions just.

Written by Paul Dughi

Paul Dughi has been with business companies for more than 20 years and has an MBA in Service Administration. He is the Founder and Chief Strategist at StrongerContent.com.View all posts by Paul Dughi Discover